is pre k tax deductible

If youre wondering whether preschool costs are tax deductible. Sadly though if you do send your children to a private preschool or private.

Can I Deduct Preschool Tuition

I have a question about a pre-kindergarten or preschool tax deduction.

. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. Tuition for kindergarten and up is not an eligible expense. The sum of your childs entire preschool tuition is not tax deductible but you may be able to get something better than a deduction.

What Do You Want For Your Child. Small business tax prep File yourself or with a small business certified tax professional. Expenses under kindergarten preschool tuition day care etc are always eligible even if the program is educational.

Children are required to go to school at age five for kindergarten. They may be but the IRS has set out strict requirements. You cannot deduct the costs of counseling litigations or personal.

6 Often Overlooked Tax Breaks You Wouldnt Want To Miss. Although kindergarten tuition isnt tax deductible the expenses for a before- or after-school care program might qualify for the child and dependent care credit. Find A Program Near You Today.

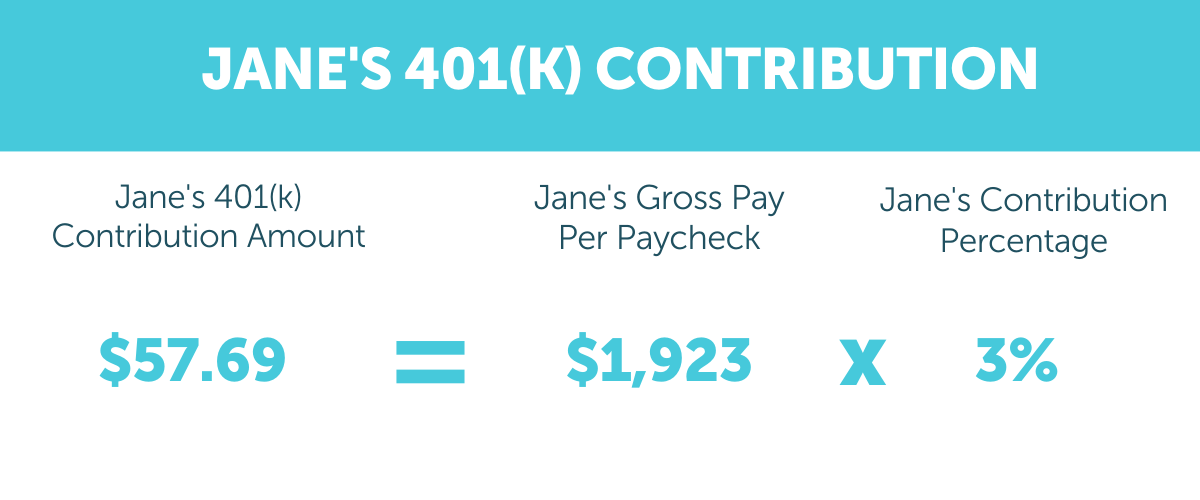

A pre-tax deduction means that an employer is withdrawing money directly from an employees paycheck to cover the cost of benefits before withdrawing money to cover. Best States for Pre-K. Although preschool expenses do.

Particularly when it comes to more expensive schools many parents are eager to determine whether or not preschool fees are tax-deductible. Ad Our Teachers are There Every Step of the Way Developing Each Child. Ad Social Intellectual Emotional Growth.

Providing a Well-Rounded Education Strong Foundation for the Future. No tuition for kindergarten isnt a qualifying expense for the child and dependent care credit because expenses to attend kindergarten or a higher grade are. A School That Feels Like More Than Childcare.

Have A Qualify Child. Paying for pre-K can qualify for a tax break but paying for private kindergarten or a private elementary. If a child attends a college or university private or public education tax credits can be used to deduct the costs of tuition books and other required supplies.

Learn More At AARP. Can I write off the tuition I pay the school for pre-K as a child care. Is private preschool tuition tax deductible.

A qualifying child is under the age of 13. Additionally you might consider. This tax benefit is available for nursery and other pre.

Join The Goddard Family Today. My son is four and goes to pre-K and a private school. Ad Over 30 Years Of Experience Nurturing Educating Children.

Although kindergarten tuition isnt tax deductible the expenses for a before- or after-school care program might qualify for the child and dependent care credit. A child must be determined as your qualifying child in order to receive the child and dependent care credit. Having a child is expensive and most of the costs are not tax deductible.

A credit called the Child and Dependent Care. Theres no doubt about the fact that you want your child to have the very best schooling from an early age. Additionally you might consider.

Assuming you meet these qualifications during the 2021 tax year you can claim up to 50 of the first 8000 that you spend on preschool tuition and other care-related expenses. Bookkeeping Let a professional handle your small business books.

/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work

Can I Claim Expenses For Preschool As A Tax Deduction

Child Care Tax Credits Can Help Families During The Coronavirus Pandemic Research Highlights Upjohn Institute

Section 619 And Free Preschool Special Education Understood

What Is A Pre Tax Deduction A Simple Guide To Payroll Deductions For Small Business

How To Take Advantage Of The Expanded Tax Credit For Child Care Costs

The Professional Development Tax Deduction What You Need To Know

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

Is Kindergarten Tax Deductible H R Block

Pre Tax Vs Post Tax Deductions What Employers Should Know

What Is The Educator Expense Tax Deduction Turbotax Tax Tips Videos

Is Preschool Tuition Tax Deductible Motherly

What Are Payroll Deductions Article

Can A Pre K Teacher Take The Teachers Deduction On The 1040

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Is Preschool Tuition Tax Deductible Motherly

What Is A Pre Tax Deduction A Simple Guide To Payroll Deductions For Small Business